Welcome to

Rent To Home Now

Rent-to-Own Made Simple.

Homeownership Made Possible.

A smarter path to home ownership.

A smarter path to home ownership.

Our rent-to-own program helps bridge the gap between renting and buying a home.

We work with families who need help with credit, down payment, or past financial challenges.

We customize each program around your situation so you can qualify for a mortgage at the end.

Our rent-to-own program helps bridge the gap between renting and buying a home.

We work with families who need help with credit, down payment, or past financial challenges.

We customize each program around your situation so you can qualify for a mortgage at the end.

Sign up to receive a step by step guide to our program and a free credit building ebook!

Ready to get started?

Click the button below!

Prefer to talk to someone first?

Call us at 587-206-7123

Text us at 587-206-7123

Rent To Home Now Application

How much do you have saved for an initial deposit (these funds go toward your downpayment)?

In the question below, you will see the minimum amount required in ideal circumstances. If the answer is left blank, your application will not be approved.

Want to research more before contacting us? We have put a FAQ page together for you!

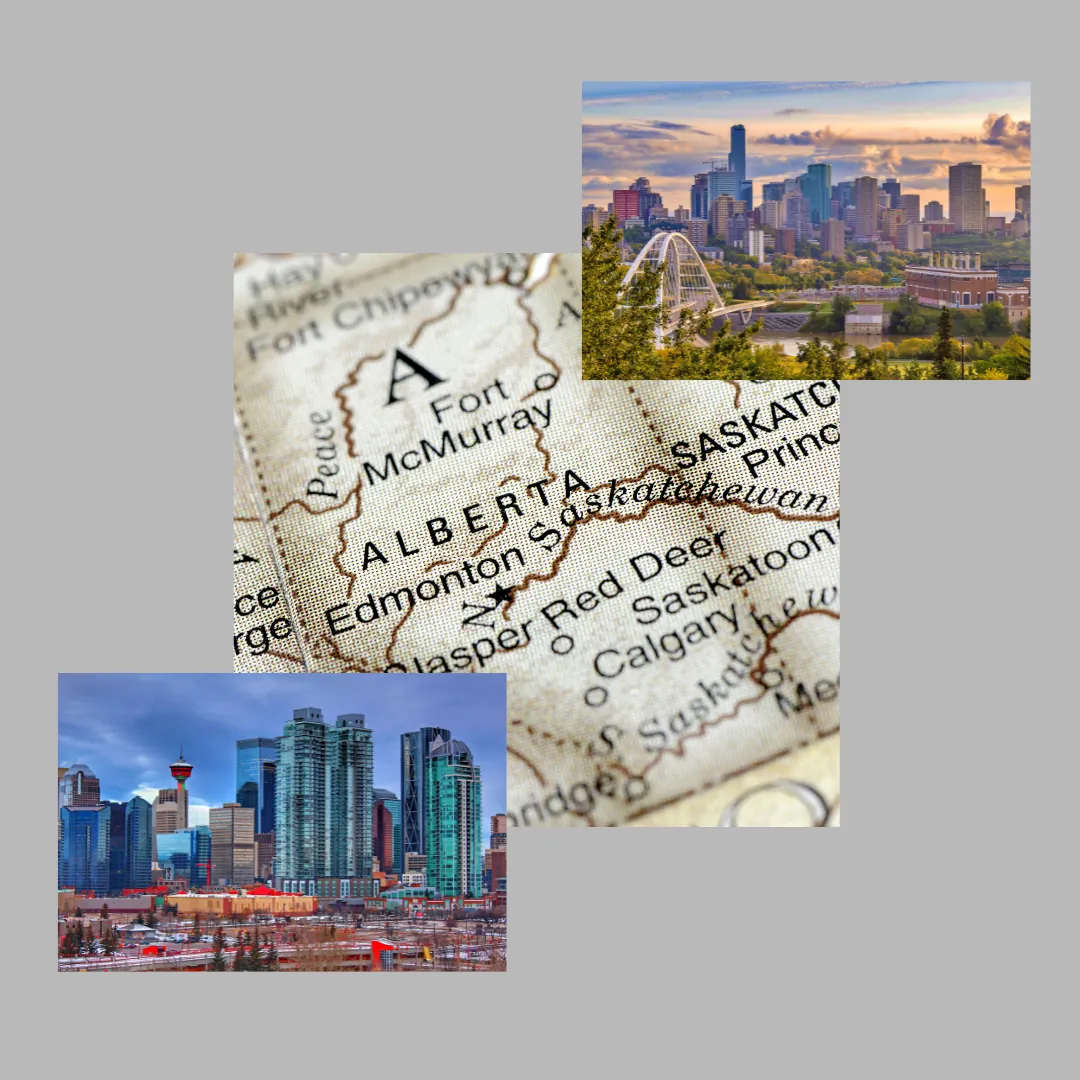

We proudly serve Alberta, Saskatchewan and Newfoundland

Our primary focus is on Alberta, but we also serve other select markets across Canada!

Some of the communities we serve include: Edmonton and area, Grande Prairie, Red Deer/central Alberta, Saskatoon, Regina, and St John's NL

We are proud to be members of the Canadian Association Of Rent To Own Professionals.